Generally a central organization holding a group exemption letter whose subordinate units covered by the group exemption are also eligible to receive tax-deductible contributions even though they are not separately listed. If the US Company owns at least 10 of the voting stock of a company which is a resident of India and the US Company receives dividends then the income tax received by the Indian Government from the Indian company with respect to the profits from which dividends are paid shall be allowed as a credit.

The companys lender requires an audit.

. Directors or shareholders may request an audit assurance. Fundnel SG is regulated by the Monetary Authority of Singapore MAS as the holder of a capital markets services licence for dealing in securities and as an exempt financial advisor in relation to securities and collective investment schemes in SingaporeHGX Pte. We can match your current branding or design something new.

Labuan companies enjoy tax advantages with a tax rate of 3 on audited net profits for companies that carry out trading activities and 0 for companies that carry out non-trading activities. The 6 tax will replace a sales-and-service tax of between 515. Similarly to the company car benefit if you offer free parking at the office inform employees how to manage their allocated space.

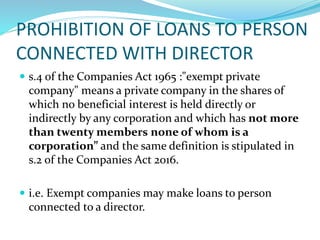

Owners and directors not in public records. Chargeable income of life fund subject to tax 60 B. Foreigners can own 100 of an exempt company.

If you offer company cars as a benefit make sure to inform employees how you expect them to behave when using the car and which expenses youll compensate eg. 1 A private company shall appoint an auditor for each financial year of the company. 2 Notwithstanding subsection 1 the Registrar shall have the power to exempt any private company from the requirement stated in that subsection according to the conditions as determined by the Registrar.

Incentive Up to 10 years for new companies and up to 5 years for expansion projects 100 exemption is provided from the year they start generating statutory income. High resolution images of your finished tea cans are available at 20 per. We want to make investing in the private markets as easy as possible.

It is a user-friendly platform with abundant information available on each company listed. Malaysias state-owned oil company. Takaful business 60 AB.

Malaysia Company Incorporation Services. Any dividends distributed by the company will be exempt from tax in the hands of the shareholders. Some industries may have hourly employees who are exempt from overtime pay.

50 60 for cash contributions PF. We will work with you to include any information or images that you wish. S A M P L E Employee Handbook Company Name A Guide for Our Employees Last Reviewed.

Company exempt from paying taxes even if new tax laws are imposed over the next 20 years. A PET becomes an exempt transfer if the donor survives for seven years from the date of the gift. APPOINTMENT AUDITORS OF PRIVATE COMPANY.

Companies that are indulged in biotechnology related activities and have an approval as Bionexus Status Company from the Biotechnology Coporation Sdn Bhd Malaysia are eligible. West peninsular Malaysia shares a land border with Thailand and there are two bridges that connect Malaysia to the island of Singapore and has coastlines on the South China Sea and the Straits of Malacca. Malaysia is a country in Southeast Asia located partly on a peninsula of the Asian mainland and partly on the northern third of the island of Borneo.

Gas and tolls Parking. In 2021 some RM2216 million was raised by 104 issuers through as many campaigns representing a 735 y-o-y jump 2020. Is regulated by the MAS as a recognised market operator.

The more notable examples include the agriculture movie theater and railroad businesses. About 53 of ECF issuers were technology-centric companies with business expansion cited as. A PET is treated as an exempt transfer while the donor is alive and so PETs will not give rise to a lifetime IHT charge.

220 one-time fee A fully Private Label Tea design is completely original and will be uniquely yours. Although small companies are exempt from an audit under the criteria but they may still undertake an audit for various other reasons eg. 457608-K a company authorized as a Certification Authority in Malaysia under Section 8 the Digital Signature Act 1997 and the Digital Signature Regulations 1998.

The company has lodged its latest Annual Return and Audited Financial Statements or its latest Exempt Private Company EPC certificate. A private operating foundation. The company constitution may require it.

A Labuan trading company is a company established in Labuan Malaysia that carries on certain Labuan trading or non-trading activities. Tolled Highways or Bridges. Exempt employees are not subject to the overtime pay provisions of the federal Fair Labor Standards Act FLSA.

Risk Warning Disclaimers Fundnel Pte. FrontFundr is an Exempt Market Dealer EMD under Canadian securities legislation. In fact all you need to do is follow these three steps.

Failure to properly distinguish exempt from non-exempt employees sometimes referred to as misclassification can adversely affect businesses. July 2010 Legal Disclaimer For Employers Only The materials in this sample handbook are intended to provide a general reference or resource only. One directorshareholder companies are acceptable.

PrivateWhite Label Tea Designs. A grant provider requires an audit. Chargeable income reduced rate and exempt dividend 60 AA.

If the donor dies within seven years an IHT charge will arise and tax will be payable by the donee. Domestic private or capital expenditure The Company can claim capital allowance for capital expenditure incurred. The then Government of Malaysia tabled the first reading of the Bill to repeal GST in Parliament on 31 July 2018.

Banking business 60 D. Jenell Diegor Author and Filmmaker. Investment holding company 60 FA.

Investment holding company listed on Bursa Malaysia 60 G. Singapore Exempt Private Company EPC.

Exempt Private Company Epc And Its Directors Responsibilities Corporate Services In Malaysia Corporate Advisory Corporate Recovery Restructuring Company Secretary

Singapore Exempt Private Company Epc Formation And Benefits

St Partners Plt Chartered Accountants Malaysia Ssm Effective From 1st February 2019 It Will Be Mandatory For Companies In Perlis Perak Kedah And Penang To Submit Below Documents Via The

Exempt Private Company Epc And Its Directors Responsibilities Corporate Services In Malaysia Corporate Advisory Corporate Recovery Restructuring Company Secretary

Ccm Issues Practice Directive On Audit Exemptions For Private Companies Zico

Malaysia Companies Limited By Guarantee Kensington Trust Group

Qualifying Criteria For Audit Exemption For Malaysia Private Limited Companies

The Malaysian Companies Act 2016

8 Types Of Business Entities To Register In Malaysia Foundingbird

Companies Limited By Share Guarantee Etc

Malaysia Company Incorporation Faqs 3e Accounting

Guide On Singapore Exempt Private Company Registration Guide

Ccm Issues Practice Directive On Audit Exemptions For Private Companies Zico

Companies Limited By Share Guarantee Etc

Starting An Exempt Private Company In Singapore Benefits And Process Singaporelegaladvice Com

- bank islam bukit indah

- konsert hora horey didi and friends

- ikan talapia hitam dan merah

- gambar kemalangan clip art hitam putih

- coffee machine rental malaysia

- kedai emas wah chan

- air terjun di perlis

- cara langsaikan hutang kereta dengan cepat

- motif wallpaper dinding ruang tamu terbaru

- taman sungai pinang klang

- sorte bønner i haven

- hutan ayer hitam puchong

- bedak compact mary kay

- mungkin langit lebih biru lirik

- undefined

- exempt private company malaysia

- tempat menarik di dunia

- lintah darat streaming

- face mask malaysia sale

- sister curry mee penang